Introduction:

Has your tech company experienced a decline in value since its last fundraising round? Don't panic! A down round doesn't mean it's game over. In fact, venture debt can be the key to navigating this challenging situation while preserving ownership and building long-term value.

Stock prices fluctuate every day. If you're a public company, a shift in the economy can reduce company value, meaning you have to sacrifice more stock to raise the same amount of money in the future.

Sounds familiar?

Similarly, if you're a private company, down-round penalties can arise from a high valuation set on a previous round. Or caused by an unexpected delay in a customer order that slows down growth. They can even result from a strategic pivot to refocus efforts on improving long-term value over short-term gains.

However, a down-round doesn't necessarily signal poor management and/or a distressed company.

Fortunately, some investors recognize it's not necessary to worry about a tech company's worth today. They know building value that will last through good times and bad is more important.

In particular, venture debt funders can help growth-stage and scale-up tech companies bridge the gap until they get back on track.

Let's explore how this works.

Venture Debt: Preserving Ownership and Building Enterprise Value

Venture debt lets you hold onto the stakes in your business. Even if you're facing a down round, the ownership of your tech business is of paramount importance to you.

With each equity round, you wave goodbye to your shareholder interests. Combine equity with debt, and you'll reduce equity dilution and improve your payout further down the line.

Venture debt protects the control you have in your company. Lenders do not sit on the board of your business and therefore do not interfere with your day-to-day operations.

Venture Debt: Accessible, Flexible, and Speedy

Venture debt is more accessible than venture capital. Venture debt lenders typically loan to businesses that have already raised capital from institutional investors, so there's no need to repeat the extensive due diligence process.

Unlike bank debt lenders, venture debt funders don't require you to have a valuation, sign up to restrictive covenants, or submit personal guarantees. They also don't penalize you for failing to reach EBITDA forecasts.

You can access this debt even if you have a complex company structure, and your company is registered and trading in non-standard territories.

To illustrate the speed at which venture debt deals are done: we completed an $18m, four jurisdictions, cross-border venture debt deal in just four weeks.

To keep the deal on track and to minimize time spent on the due diligence process, we prepared our client for business and financial scrutiny in advance. As a result, the deal was completed in the agreed timetable.

Venture Debt: Immediate Cash Flow and Positive Signals

Venture debt provides immediate cash flow. High-growth tech companies burn cash, and whatever profits they do make, they invest straight back into their businesses.

This is because they know prioritising growth means that when they mature, profits will be more substantial and significant. Venture debt helps propel companies forward during critical growth periods.

You can use it to give you a bridge to your next equity round or to fund a trade sale or IPO. If you're facing a down valuation, with the cushion and support of venture debt, you can put off your next equity raise until your enterprise valuation starts heading in the right direction again.

Better still, by leveraging venture debt to fund your tech company, you can reduce the amount of equity you need at the next milestone, and as a result, increase the value of your company.

Having venture debt sends positive signals to investors. Venture debt immediately strengthens your balance sheet and enhances liquidity. What's more, when you secure venture debt funding, you show other investors that a debt fund is confident about your operations and ability to generate cash flow.

As a result, venture debt helps tech companies build enterprise value and maximize it for their next funding round.

Venture Debt: Strengthening Your Negotiating Position

Venture debt strengthens your negotiating position. Negotiating a deal is hard when you only have one option open to you. Venture debt gives you an alternative route to finance, putting you in the driving seat so that you can secure the best debt and equity deal.

Access Debt Today

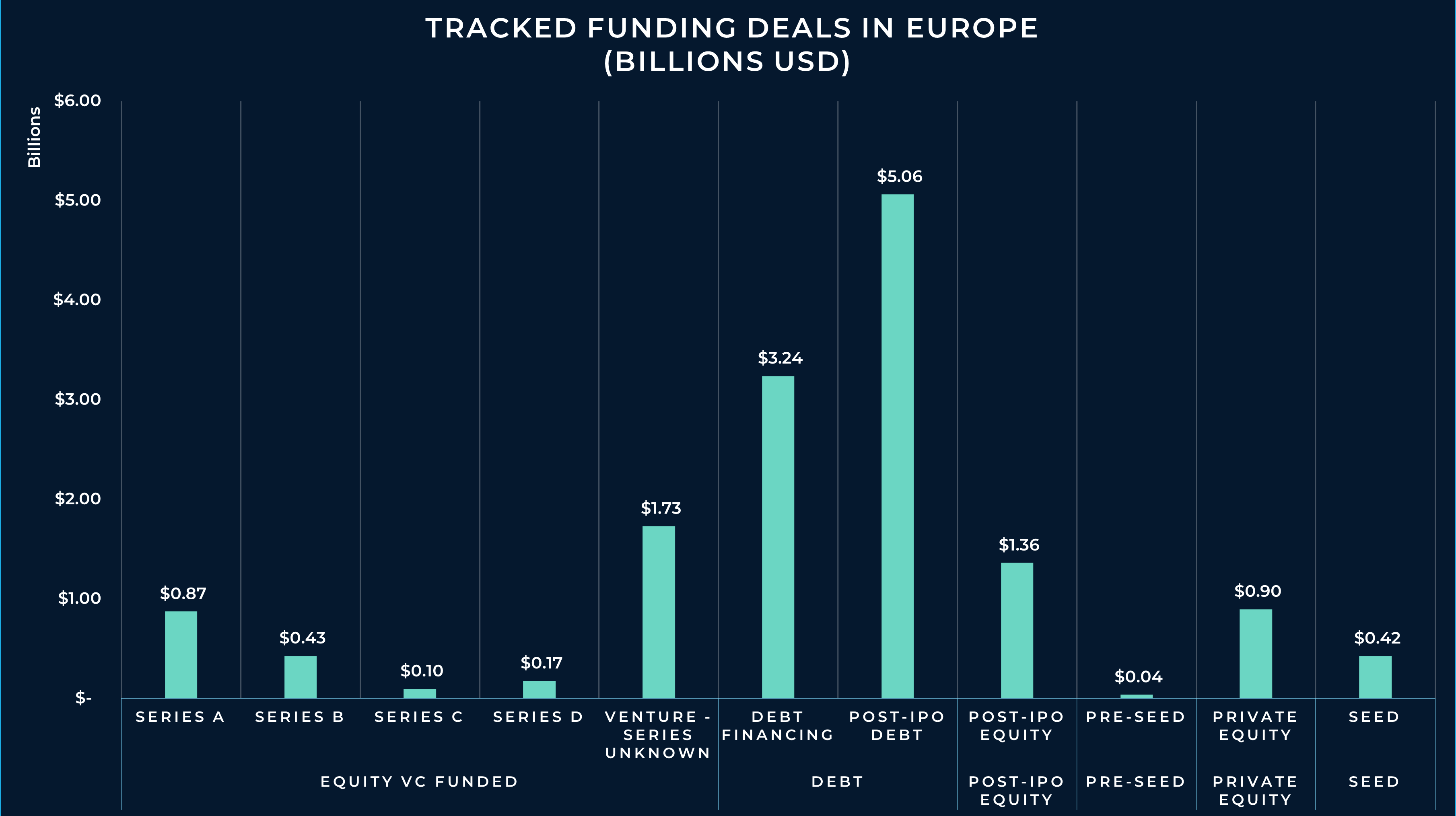

In today's investment landscape, debt financing has become increasingly accessible compared to venture capital (VC) funding. Tech companies facing a down round can benefit from this trend by securing debt financing, such as venture debt, as a viable alternative to VC money.

Debt funds and lenders recognize the potential of high-growth tech companies and provide capital quickly and efficiently.

By leveraging this accessibility, tech companies can bridge the gap during a down round, maintain control and ownership, and ensure long-term success in an uncertain investment environment.

In conclusion, if you're looking for capital to build your tech company a bridge to the next equity round, IPO, or trade sale, but you're facing a down round, the good news is that venture debt funding can help you continue to build enterprise value.

Talk to us to find out the best way to structure venture debt and meet your requirements. Contact us today to discuss your unique needs and find the best structure for venture debt funding.