Private Debt Europe

A HQ for private debt in the Northern & Eastern Hemisphere

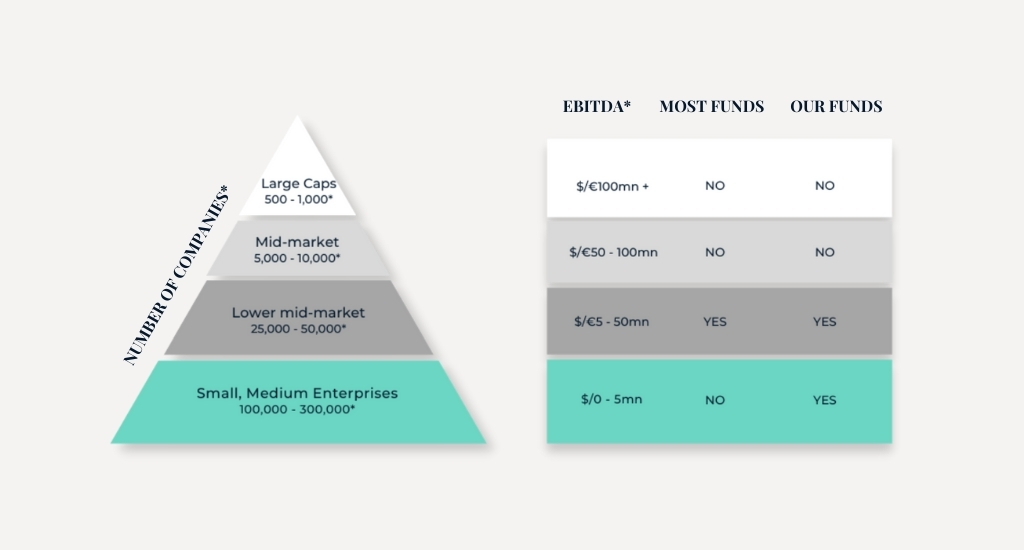

Note that these are in reference to corporate lending, and does not refer to real asset lending, such as lending to real estate and infrastructure projects.

Private debt has been around for a long time, but private debt funds only came into being in the late 1980s/1990s. The asset class began to gain more prominence in 2007 and 2008 but volumes crashed soon after as the Global Financial Crisis (GFC) struck.

However, post-GFC, stricter regulatory requirements served to reduce bank lending to private borrowers. On the flip side, demand for capital (e.g. M&A) grew rapidly. As such, the asset class recovered rapidly to replace the void left by the pullback in bank lending.

We see in the funds raised for private credit – the figure has almost quadrupled, growing from US$39b in 2009 to US$152b in 2018. Although there is no central directory of private debt funds, Preqin’s database shows that over 2,000 private debt funds have been raised over the past five years.

Since 2013, we have built a trusted network of over 300 of the best private debt funds who are ready to allocate capital to help businesses like yours grow.

It is common for businesses to look in their home country for debt and financing options. However, the best interest rates, loan terms and loan structure for your business could be located in other parts of the world.

At Fuse Capital, we can help you tap into our global network of over 300 funds. You no longer have to search for private debt funds and reach out to each one individually, therefore saving you precious time and effort.

With our deep expertise in the space, we know who to speak to, how to best present your business, what loan type and structure fit your business, and we can help you fight for the best loan terms.

Different private debt funds have different underwriting styles and preferences. In general, before approaching a private debt fund, you must be very clear on the following items:

That last question is key, as most private debt funds will only lend to businesses generating EBITDA of over £5m.

Should you find your business in the lower brackets as shown in the following image, you would find yourself shut out by most private debt funds.

Source: Campbell Luytens (2019)

Fortunately, for pre-profit technology businesses with a revenue of at least £2mn, we know where to go to get your term sheets and we specialize in getting the best terms for you.

Like with any industry, our lending operations rely on relationships forged over time. We know every one of our private debt funds on a personal level and have transacted with most.

Our fund’s credit and underwriting policies are crystal clear. We understand their mandates and can share them with you with confidence.

As we save our partners a lot of resources, we are able to secure for you better loan terms and in a shorter period of time.

Certain parts of the world have a stronger presence of private debt funds, below you can take a closer look at some of the regional HQ’s we work with:

A HQ for private debt in the Northern & Eastern Hemisphere

A regional HQ for private debt in Asia and Southeast Asia

A regional HQ for private debt in the United Kingdom

Time to discuss your goals and needs

Proof of your business model

A clear use of funds

A typical process can take anywhere from 8-12 weeks, and the following chart illustrates how the overall process will look like:

Day One

Kick-off meeting

Day One

Kick-off meeting

Week One

Client sends data

Week One

Client sends data

Week Two

We create your private debt deck for funds

Week Two

We create your private debt deck for funds

Week Four

We approach private debt funds & get offers

Week Four

We approach private debt funds & get offers

Week Five

Fund/Borrower intro meetings/calls

Week Five

Fund/Borrower intro meetings/calls

Week Six

You accept an offer & due diligence begins

Week Six

You accept an offer & due diligence begins

Week Seven

Loan documentation

Week Seven

Loan documentation

Week Eight to Twelve

Drawdown funds

Week Eight to Twelve

Drawdown funds

“Knowing who to talk to and what to talk about is Fuse Capital’s significant value-add. In fact, it can take years to build the types of relationships and trust that Fuse Capital already has.”

“Thank you to the team at Fuse Capital for helping secure financing on great

terms. Fuse kept everyone well informed throughout the process, and used

their experience to smooth each party’s way through the deal. They’re a great

choice for helping scale technology businesses.”

“I chose Fuse Capital because I knew they could deliver at a time when it mattered most. We wanted experts in their field who could save us time and get us the best deal and they did exactly that.”

“Thank you Fuse Capital for all the support. It was a pleasure working with the entire team

“Fuse Capital has now successfully delivered debt funding to our business for a second time. We consider them to be true experts in their field and wouldn’t hesitate to refer them to any business looking to raise debt. Thank you for your professionalism and diligence.”

.png?height=180&name=simplestream_logo@2x@2x%20(1).png)

“The support and advice our team has received from Fuse Capital has been invaluable. I would like to thank the team for their hard work especially through COVID times. Whilst we have been focused on business operations, the Fuse team were able to successfully secure essential growth funding for our future”

“Fuse Capital’s experience working in the private debt market gave us confidence that we could source the growth funding we needed without restrictive covenants or diluting our equity. The process of working with Fuse Capital was professional and easy. They were committed to getting the deal done and their knowledge of our business and industry and the debt market meant they produced a high quality investment memorandum.”

“Fuse Capital went the extra mile in putting together our investment memorandum. The result was a highly detailed, realistic and marketable proposition. I’m convinced the level of detail Fuse Capital put in led to our swift receipt of term sheets.”

“I liked the fact that Fuse’s team was more than happy to roll up its sleeves and do the work, Fuse Capital’s services complemented our management team’s expertise, so we could focus on the most important issue at hand… running our business.”

“Fuse Capital went the extra mile in putting together our investment memorandum. The result was a highly detailed, realistic and marketable proposition. I’m convinced the level of detail Fuse Capital put in led to our swift receipt of term sheets.”