As a business leader, you’re always looking for ways to raise capital for your business. You’ll have likely already raised some equity, and now your business has matured, it’s time to consider debt.

But the question is, debt or equity, which is cheaper?

In part two of the four-part venture debt guide, we will help you understand the costs of debt financing vs equity financing and explain the pros and cons for both.

Of course for any business, it’s mostly about the numbers, so let’s start with those:

Use the contents section below to skip to specific areas of interest.

What does a £2 million Investment Cost?

For example, a £2 million investment into a software company worth £20 Million ( 5X ARR) today gets sold for 200m after 5 years from investment.

1. Equity Investment of £2 Million = 10% Equity dilution = £2 Million

After 5 years, the company is now worth 200m.

Total cost of Equity = 20m

You have no immediate repayment obligation.

2. Debt Investment of £2 Million over a 4-year term, non-amortising at 8% Interest and with a £200k Equity warrant

After 5 years, the company is now worth 200m.

Total interest paid = £160,000

Equity warrant = 2m will be paid at IPO or Trade sale.

Total cost of debt = >3m

Once you pay back the loan, your liability comes to an end.

If you would like to read more about the repayment terms, you can skip ahead to part four of the guide here.

Equity Deal Breakers

With equity, you are giving up shares of your company, so, if you’re planning to reap the rewards of your work long term, this will decrease your future earnings.

Equity financing takes a long time to secure, so if you’re in the midst of a time-sensitive expansion or the market is ripe now, debt financing is the express route to finance.

Debt Deal Makers

Interest payments are relatively low, so for a debt fund to lend, loans are subject to lite covenants and secured by shareholder guarantees. It’s these terms which make lending more attractive, without them debt deals simply wouldn’t exist.

As mentioned earlier, there are also terms involved called ‘Equity Warrants’. These come into play when a significant liquidity event occurs, such as a Trade Sale or IPO.

We’ve written a detailed blog for you explaining these too, click here.

Why Equity is More Expensive than Debt?

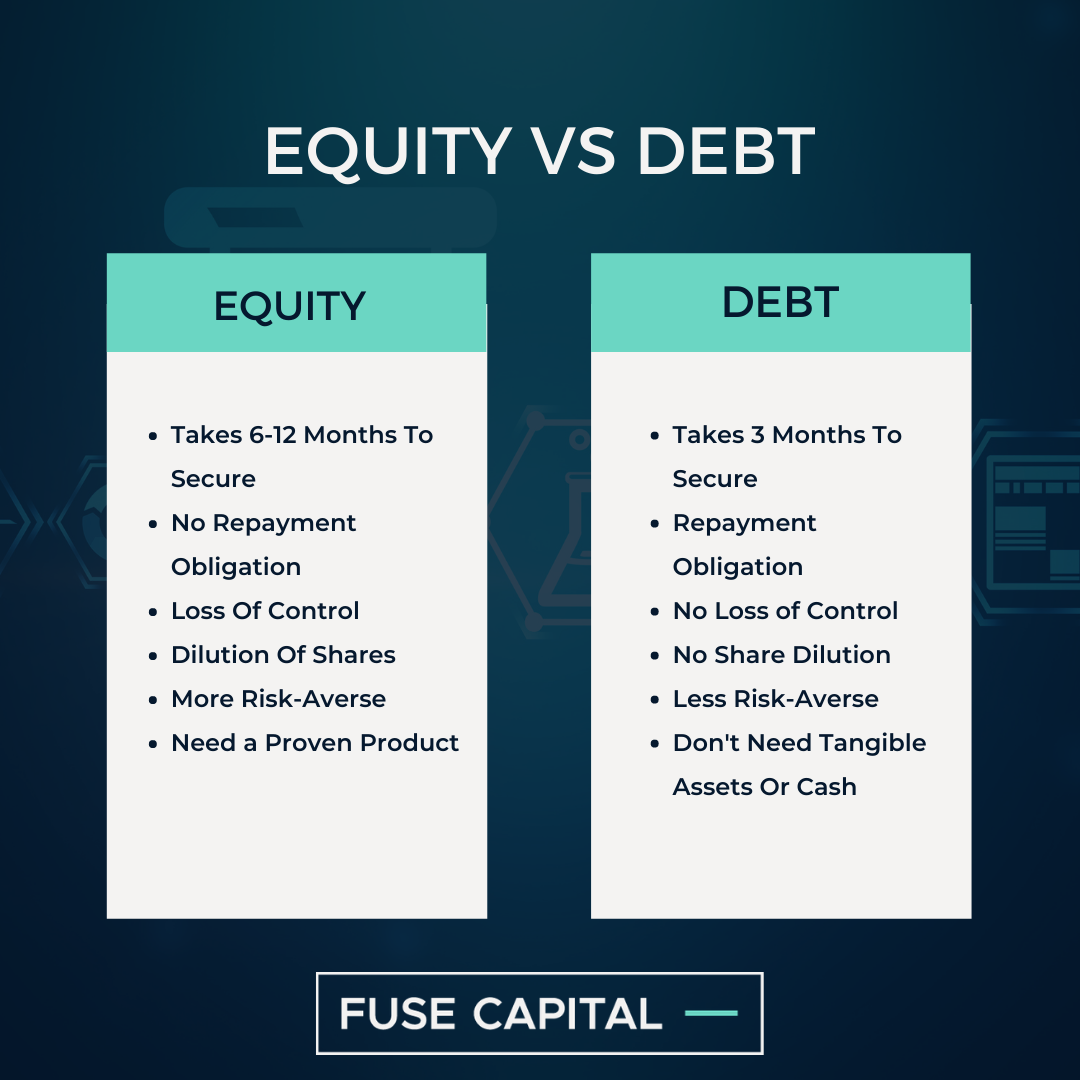

The bottom line is this. It can take 6-18 months to secure equity investment. It takes a maximum of 3 months to secure debt. Moreover, you’ll have a loan secured pragmatically and not restricted by heavy covenants.

Beyond that, you can be secure in the knowledge your debt investor will not try to pull the plug at the first sign of trouble.

Better still, not only will you retain equity, but the nature of your loan means you’ll be able to achieve the benchmark you need to get better terms when you raise capital in your next funding round.

Consequently, debt is cheaper than equity, and when you exit, with less equity dilution, this is where you’ll gain and appreciate how debt supported your strategy for the not-so-distant future.

It Pays to Talk to Debt Funds

Here’s the thing, because debt finance is provided by specialists who understand the risk profile of early-stage, loss-making tech businesses, they’re more likely to believe in the proposition.

In particular, they’ll appreciate the developed technology and modern commercial models, and therefore be able to structure a deal that works for your twenty-first-century business and growth ambitions.

Skip ahead to part three of the guide here where we will be discussing the different between Venture Debt vs Venture Capital.

If you do have questions which haven’t yet been answered about venture debt for your technology business, drop us a message here.