With the global population exploding and climate change problems growing, a new generation of tech companies looks to tackle the food production crisis head on.

The industry is forecasted to reach an estimated $9.6bn by 2025 (Grand View Research) and with investors itching to get a piece of the pie, the only way is up for urban farming.

I sat down with LettUs Grow co-founder, Jack Farmer, to discuss the possibilities and challenges his industry faces.

Shall we start with start with what is vertical farming?

Vertical farming is the practice of growing crops in a vertically stacked environment.

This method involves soil-less growing techniques such as aeroponics, hydroponics, and aquaponics.

Health and Environmental Benefits of Urban Farming

The benefits of aeroponics are plentiful, as Jack explains: “The core principle of aeroponics is that you’re generating a much healthier rootstock with greater access to oxygen”.

“With a raw yield perspective, it allows us to grow more per year, growing to produce faster and supporting larger plants. From a product perspective, if you’re looking for a healthier root stock there’s an advantage there because aeroponics generates cleaner, healthier plants”.

“Hydroponics will claim to save 70% to 95% water depending on how you’re capturing it out of the system. With aeroponics, you’ve got an even more efficient application of that water, so you can use less water to deliver the same amount of water and nutrients”.

“One of the key problems with food supply at the moment is externalities. The nature of the food supply system is that you find a great place to grow something, you grow it there and then you ship it.”

“Whilst that is great from a cost-based perspective it generally externalises the cost of the product from the consumer and particularly when you look at environmental externalities and the risk of that supply chain to climate change, in my view it is better to almost re-nationalise certain levels of production. Yes, it may have a cost implication, but that cost implication doesn’t have externalities to it, which to me is the key thing when building a resilient food system.”

Can Vertical farming become mainstream?

“I think it is on track for expansion, particularly if you use glasshouse in that segment, it already is mainstream. The question is, can the newer technologies that are coming in across the board (particularly in vertical farming), become mainstream? And with aeroponics, I think the answer’s yes, but it will likely be on a crop specific basis, that productivity advantage is useful in certain scenarios, particularly in the vertical farming space.”

What about funding for Agtech?

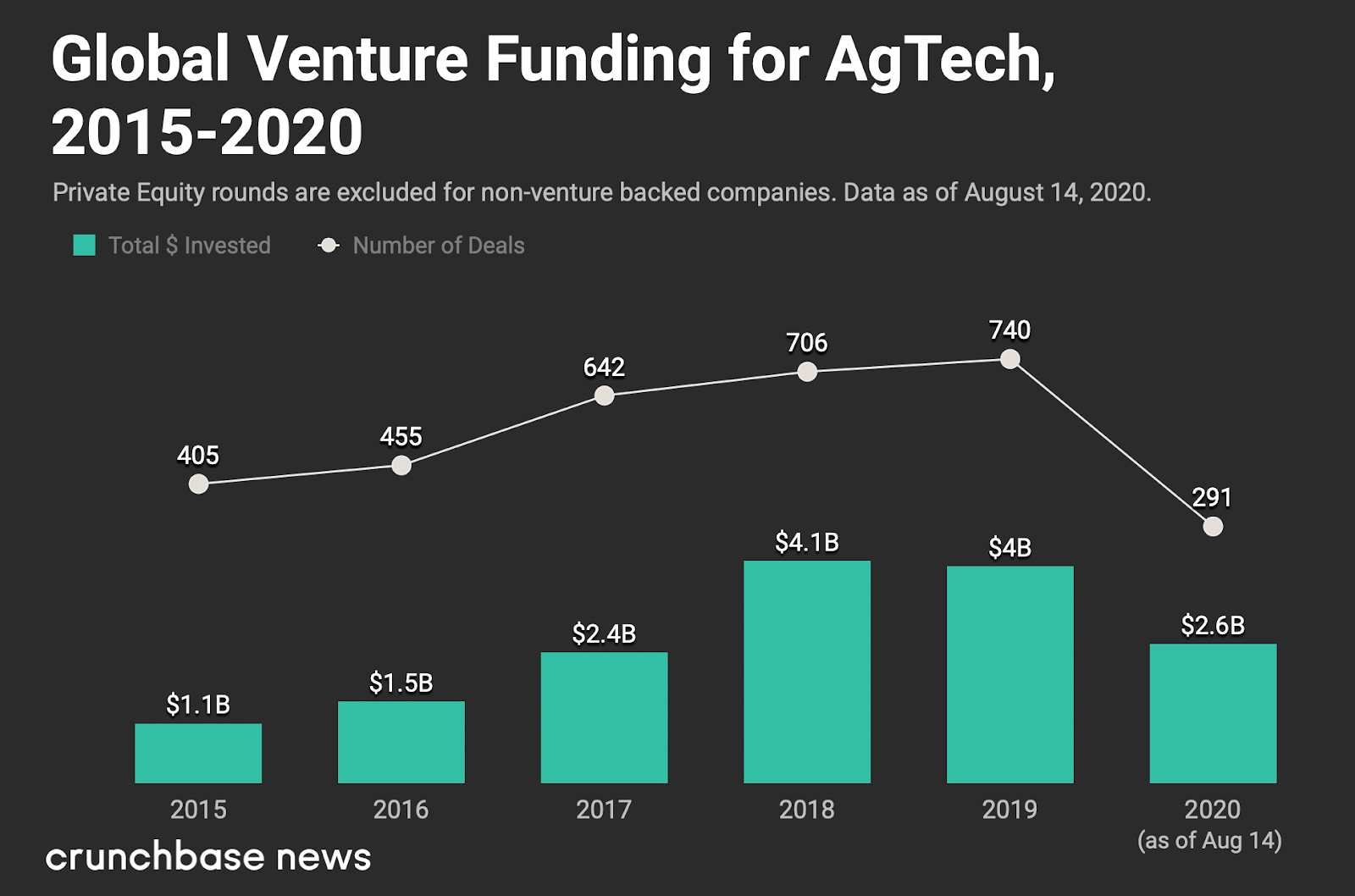

With growth comes the issue of funding. The Agtech sector as a whole has had a steady increase in equity investment in the last 5 years with 740 deals completed in 2019 compared with 405 in 2015 and is on track for another record-breaking year in 2020. Vertical Farming Companies such as Plenty, Freight Farms, Infarm, and Aerofarms have all attracted big investment rounds this year.

Source – Crunchbase

But, equity is not the only source of funding for these start-ups…

Private debt funding is becoming all the more common with new debt funds getting involved in the market every week.

Russell Lerman, co-founder, and head of lending at Fuse Capital explains “For vertical farming companies there are a few options. Firstly there’s funding at the opco level, so people, technology, marketing, distribution and financing the growth. Then there is asset backed finance. Asset backed finance is a very mature type of finance and has been around for a very long time. What we’ve managed to do with asset backed finance is using our experience with high growth tech businesses, we can take the old asset classes of asset backed finance and apply it to new world business models, such as vertical farms.”

“It’s a very new market but there is plenty of money available for these companies. There are a lot of lenders who are willing to take a more conservative view and are happy to stick with more traditional assets, however, there are funds and lenders out there who are the ‘first movers’ in that they are pushing the boundaries on the assets and are willing to understand the new asset class. They’re active in this market and they’re the people we’re working with for these types of deals”.

What’s next for the industry?

Like all new industries, there will be question marks over how urban farming can be made profitable. Many of these companies will be looking to prove the doubters wrong and take the leap to profitability in the next few years, and with the amount of investment and funding going into the industry, you’d be a pessimist to say they won’t.

Vertical farming solves a massive problem within our food industry. With a rapidly rising population and climate change becoming more of a problem every day, we need to look beyond our existing methods of farming and strive for a more sustainable future.

For more information on DROP & GROW, a LettUs Grow product which includes aeroponic farming solutions and farm management software, please click here.