Facing a down round—the scenario where a company secures funding at a lower valuation—entails significant repercussions for stakeholders. Explore the impact on the cap table and investor relations, covering key aspects like ownership dilution, shifts in shareholder control, and the strategic role of venture debt.

Outline

- Dilution of Ownership

- Impact on Valuation of Shares

- Change in Shareholder Control

- Preferences and Rights of Preferred Shareholders

- Anti-Dilution Provisions, and Convertible Notes

- Employee Equity Participation

- Perception and Future Fundraising

- Founders and Early Investors

- Venture Debt as a Strategic Solution

- Real-World Examples or Case Studies

Dilution of existing shareholders

Let's say a company initially raised funds at a valuation of $50 million, which equates to $10 per share (considering 5 million shares outstanding). Investor A owns 10% of the company, possessing 500,000 shares at this valuation.

In a down round, due to market conditions or other factors, the company raises more capital at a lower valuation of $25 million, which values each share at $5. The company decides to issue an additional 2 million shares at this valuation.

If Investor A decides not to participate in this down round, let's calculate the impact on their ownership.

Before the down round:

- Valuation pre-money: $50 million (5 million shares outstanding: price per share at $10)

- Investor A owns 500,000 shares out of 5 million total shares (10% ownership).

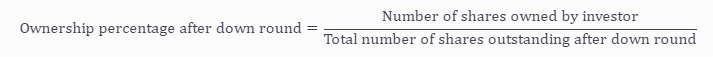

After the down round, using this calculation:

- Total shares outstanding: 7 million (5 million original + 2 million new shares)

- Investor A still owns 500,000 shares.

Using the calculation it gives us:

![]()

- Investor A's ownership percentage reduces to approximately 7.14% (500,000 shares out of 7 million total shares).

This reduction in ownership from 10% to approximately 7.14% demonstrates the dilution impact caused by the down round.

Conclusion:

Investor A's ownership percentage decreases. This happens because the total number of outstanding shares increases due to the down round. Even though Investor A still has the same number of shares, their ownership percentage goes down.

Dilution of Ownership

The down round typically involves issuing additional shares at a lower valuation, which dilutes the ownership percentages of existing shareholders who do not participate in the new round. In the example provided, Investor A's ownership decreased from 10% to approximately 7.14% due to the issuance of new shares at a lower post-money valuation.

Impact on Valuation of Shares

The lower valuation in the down round affects the value attributed to each share. Existing shareholders might witness a reduction in the value of their shares, potentially impacting the perceived worth of their investments.

Change in Shareholder Control

The change in ownership percentages can alter the control and decision-making power within the company. Certain shareholders might find their influence reduced following the dilution caused by the down round.

Preferences and Rights of Preferred Shareholders

Down rounds often involve issuing new preferred shares with different rights or preferences compared to the existing ones. New investors in a down round can request improved terms. These terms may alter their investment rights in comparison to previous rounds.

Additionally, they can affect the order of preferences during liquidation or dividends. They also might issue liquidation preferences which are not optimal for you and your existing shareholders.

Anti-Dilution Provisions, and Convertible Notes

In the context of a down round, the use of anti-dilution provisions becomes particularly relevant. Anti-dilution mechanisms, such as the full ratchet provision, aim to protect existing investors from the impact of a reduced valuation.

If Investor A had negotiated for full ratchet anti-dilution protection, their conversion price per share would be adjusted downward to the price at which the new shares are issued in the down round. This adjustment helps mitigate the dilution effect. This ensures that the lower valuation does not unfairly penalize investors.

Additionally, if the company had previously issued convertible notes, the down round might trigger conversion into equity at a lower valuation than initially anticipated by the noteholders.

Convertible note terms play a crucial role in determining the number of shares issued upon conversion. A down round could result in a higher number of shares being issued than initially expected, further impacting the cap table.

Stakeholders need to understand the impact of anti-dilution provisions, convertible notes, and down rounds on the company's long-term health. This understanding helps them navigate equity structures and negotiate terms.

This knowledge helps them navigate equity structures and negotiate terms.

Employee Equity Participation

The down round could impact employee stock options or equity incentive programs.

If we set the strike price for stock options based on a higher valuation, these options may become less attractive or even underwater, impacting employee morale and retention.

Perception and Future Fundraising

A down round might signal distress or operational challenges within the company, impacting its perceived attractiveness to potential investors.

Fundraising may become difficult if investors view the company as costly or having growth issues.

Founders and Early Investors

The company's declining worth could significantly impact the value of stakes owned by founders and early investors. This, in turn, would affect their financial interests and motivation.

Use Venture & Private Debt To Bridge To The Next Round / Avoid Downturn

.jpeg?width=1700&height=1133&name=AdobeStock_665703289%20(1).jpeg)

In the volatile landscape of venture capital, a down round casts a shadow of uncertainty over a company's trajectory. When a company raises capital at a valuation lower than its previous funding round, it signifies a down round. This scenario introduces a cascade of challenges, potentially denting investor confidence, threatening the valuation of the previous, and stirring apprehension among stakeholders.

Venture Debt

Amidst such challenges, venture debt emerges as a strategic lifeline. Unlike traditional equity financing, venture debt offers a distinct advantage by providing capital without the need to sacrifice existing shareholders' ownership. Essentially, it's a form of debt financing tailored for high-growth startups, characterized by its non-dilutive nature.

Specific Ways Venture Debt Helps in a Down-Round

Bridge financing:

Venture debt acts as a financial bridge in tough times, providing temporary help that extends the company's financial stability. This temporary infusion of capital buys time for the company to navigate toward a more favourable valuation.

Preserving Equity:

Utilizing debt rather than additional equity safeguards ownership percentages for founders and existing investors, particularly crucial when facing a down round. It prevents more ownership loss and keeps the shares for those who have been involved since the beginning.

Accelerated Growth:

Venture debt empowers companies to pursue growth initiatives that fortify their standing for future funding rounds. Whether it's channelling resources into marketing, research and development, or hiring pivotal talent, this influx of capital accelerates growth trajectories.

Flexibility and Customisation:

A hallmark of venture debt lies in its flexibility, offering tailored solutions aligned precisely with a company's needs. From repayment structures to interest rates and covenants, this flexibility aligns financial support with the company's growth strategy.

Building Credibility:

Adding venture debt to the capital structure makes investors and stakeholders feel more secure and confident. It portrays adaptability and resilience, key factors in weathering the storm of a down round.

Real-World Examples

Look into our case studies of businesses we helped bridge to the next round in a downturn, effectively preventing them from raising a down round:

If your company is looking into alternative financing to avoid a downturn, or if you're simply interested in what growth debt could unlock for your company, reach out to us down here:

Conclusion

A down round, where a company secures funding at a lower valuation, brings substantial implications for stakeholders. We explored impacts on the cap table and investor relations, including ownership dilution and shifts in control, highlighting complexities.

In this landscape, venture debt emerges as a strategic lifeline, offering a non-dilutive solution, showcased by real-world examples.

In the dynamic realm of finance, understanding these dynamics is crucial for informed decision-making and resilient business strategies.

.png)