To navigate your tech company around the S-Curve to growth, you need one essential ingredient: money.

Did you know that with debt finance as part of your capital structure, not only can you reduce dilution, but also you can maximise available capital?

You see, as the foundation of your growth strategy, debt finance serves as the resource you need to kick start your growth, negotiate inflection points, and execute your growth plan.

What Is The S-Curve?

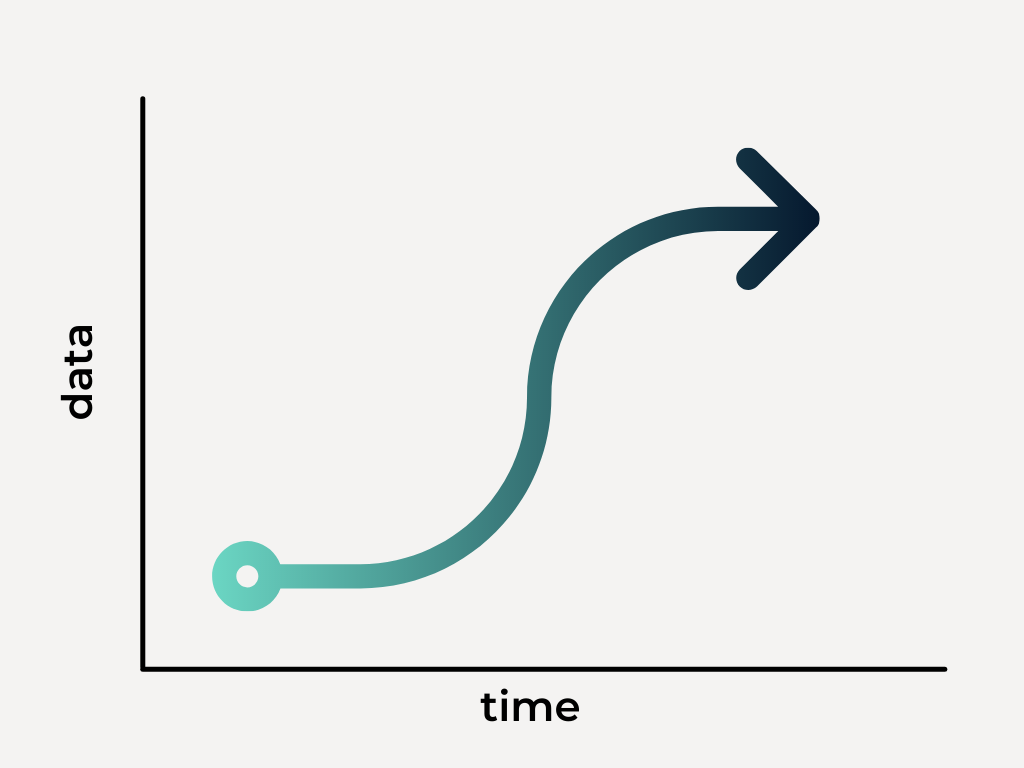

Business growth doesn’t follow a linear path. More often than not it follows a curve. In simplest terms, the S-Curve models how your business will grow over its lifecycle.

Initially, startup growth is slow. Then, as markets recognise how your products/services solve problems, you can expect rapid growth to ensue. This rapid growth continues when you scale your business to cope with increased demand while maintaining efficiency.

Later on, as your business matures, internal and external factors such as new entrants to your market may slow your growth and you’ll reach a growth plateau. At this point, the ability to respond to changes quickly is vital.

How Does Debt Finance Fit Into A Tech Company’s Growth Strategy?

When you understand the S-Curve, you can strategically plan your finances around it.

Let me show you how this works:

Step 1: When you grow your business

You add resources at the same time you accelerate revenues. For example, you take on new staff, move to new premises, or increase your client base by expanding your sales and marketing efforts. The problem is your costs increase in line with your growth.

When you’re burning cash, you can use venture debt to extend your cash runway without diluting the equity of existing investors and founders.

Step 2: When you scale your business

You aim to move your tech business into profitability by increasing revenue without incurring further significant costs.

Here, debt finance can help you to improve efficiencies by giving you the capital you need to automate processes cost-effectively. Better still, it can be organised quickly.

Step 3: When your tech business reaches maturity

You’ve reached the top. Now you need to stay there. But growth is slowing, and you see new competitors entering your market.

Debt finance can support M&A activities, global expansion, and share buybacks.

Step 4: Navigating inflection points

By inflection points, I mean when you need to respond to a plateau of growth in the business environment or face a downturn.

Debt finance gives companies the resources required to enter a new growth stage, fund working capital, and scale up existing operations while reaching new markets.

If you have an upcoming capitalisation event debt finance buys you time and gives you a protective ‘financial’ cushion so that you can get back on track before heading into the next round.

But you’ve explored debt finance and were turned away before

When banks stopped lending after the financial crisis, alternative private debt funds stepped in to fill the space.

Private debt funds understand tech company business models. What’s more, they align their appetite for lending to that of the borrower’s equity lenders. As such, private debt funds can tolerate the risk associated with high-growth tech business models and react more quickly to opportunities and challenges. As a result, they offer more flexibility when structuring loans.

When to seek debt finance to see you through the S-Curve to growth

Impeccable timing, flawless execution, and sustainable momentum are at the cornerstone of the success of the best strategists, innovators, and growth leaders.

To seize opportunities and maintain the momentum, it’s recommended that you raise finance before you need it. Without a doubt, the earlier you raise finance, the better position you’ll be to negotiate and secure the best terms.

Where to look for the money?

The private debt fund market is fast growing. To save you time searching the market and comparing different debt deals, talk to a specialist debt advisory and brokerage firm.

This legwork will save you the overall cost of your capital. What could be more important?