Business Overview

Our client is a global B2B SaaS loyalty software provider that has achieved remarkable success in the financial services sector. With a focus on delivering comprehensive reward options, international coverage, and advanced technology,

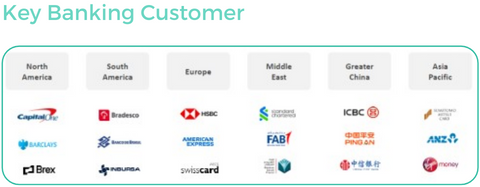

The company has established itself as a trusted partner for over 60 enterprise-level clients globally, including Visa, American Express, HSBC, Standard Chartered, and Capital One.

Headquartered in Singapore, our client operates off-shore tech centres in Asia and Europe, enabling it to serve clients worldwide. The company's success is attributed to its experienced leadership team, institutional investor support, and commitment to delivering exceptional results for its clients.

Opportunities Leading to Financing Needs

Our client sought private debt financing to address specific challenges and capitalize on growth opportunities. The company identified the following areas as critical for driving growth:

Technology & Business Development:

- Configurability Upgrades and API Capability Expansion:

- Business Development & Marketing Team Expansion: Strengthening efforts in B2B marketing and outbound lead generation.

- Working Capital Buffer: Allocating funds to ensure financial stability and support growth initiatives.

Suitable Lenders For Unique Business Dynamics

Their financing requirement was larger than most local funds are able to provide in SEA, hence Fuse focused on UK and European lenders who would not only have the ability to fund the transaction today but also support future growth.

KPIs for Building a Compelling Case

Our clients focused on key performance indicators (KPIs) such as Annual Recurring Revenue (ARR) and churn rate to build a persuasive case. These metrics demonstrated the company's strong growth trajectory and its ability to retain clients, showcasing its financial stability and market position.

Challenges in Presentation & Negotiation

During the presentation and negotiation process, the company faced specific challenges due to the specificity of its business. They hadn't raised equity funding for a long time, which made valuations outdated and difficult to gauge for lenders.

Additionally, the multi-jurisdictional nature of their revenue stream added complexity to the Facility and Security documentation, requiring thorough expertise and guidance.

Cross-Border Funding & International Scaleup Profile

Our client pursued cross-border funding opportunities and had an international scaleup profile. The company faced jurisdictional challenges, particularly in Asia, where it operated in multiple markets.

With the help of Fuse Capital, they navigated the complexities of international financing, leveraging their expertise in market practices and negotiations to reassure lenders and facilitate communication.

Why Working with Fuse Capital?

The company chose to work with an advisor instead of pursuing the financing process independently due to time constraints, the ability to access global funds, and internal resourcing constraints.

Our clients' former investors valued the advisor's relationships and expertise on both sides of the globe. Fuse Capital provided support in negotiations, forecasting, presentations, and cross-border considerations.

Fuse Capital played a crucial role in facilitating negotiations, detailed “debt ready” financial forecasting and modelling, and providing guidance on cross-border complexities. Our expertise and market knowledge helped our client navigate the financing process effectively.

Testimonial from CFO

"Working with Fuse Capital has been a game-changer for us. Their expertise and deep understanding of our business dynamics were invaluable during our fundraising journey. Fuse Capital's extensive network of investors allowed us to secure the growth financing we needed to fuel our expansion plans and capture new opportunities."

.png)