Private Debt’s upside is to not have your equity diluted. So it might feel counter-intuitive to give up some of this equity through a warrant in a debt deal.

There’s a logic to warrants, however, from the private lender’s perspective, and it ALWAYS amounts to less cost of capital acquisition than an equity funding round.

What are warrants, and what are the types of warrants you might encounter? It's important to know what you’re getting into.

Here's a list of what we will go over in this article:

- What are Warrants: Equity Financing?

- Key Elements of Warrants & Coverage

- Capital Raising: Equity vs. Venture Debt

- 3 Types of Warrants

- Are Warrants Changing?

- Does it Affect the Fundraising Process as a founder?

What Are Warrants: Equity Financing?

Warrants are documents or instruments issued by a company as proof of the ability to convert options, rights, or privileges to acquire shares at a specific price until a fixed expiration date.

Warrants do not usually provide Warrant holders with dividends or voting rights. As such, they are only valuable for their potential profit.

On the one hand, companies use warrants to attract investors or negotiate favourable deals, for example as an incentive for investors to invest or for a lender to loan funds at a lower interest rate.

On the other hand, warrants are a way for lenders to capture the upside they’re providing by taking on extra risk with the investment.

Warrants are similar to options, but options are usually given to internal stakeholders like employees and directors, whereas warrants are usually offered to external parties, in this case, your lender.

They are usually evidenced by a document called a warrant certificate, which outlines the key terms of the warrant such as exercise price, number of underlying shares and the term of the warrant, procedures and conditions for exercising the warrant, and adjustment provisions to protect the value of the warrant.

Key Elements of Warrants & Coverage

A warrant includes the number of shares holders are entitled to, the strike price at which the warrant can be exercised, and the expiration date by which the warrant must be exercised.

Warrants are usually presented in terms of coverage, expressed in a percentage of the amount of the loan. There’s no fixed amount, but a warrant typically covers 10 and 20% of the loan.

Typically, warrants are only used when a company is about to exit, such as through a listing, sale of assets, change of control, or liquidation. If the company does not perform well, the warrants may not have much value.

However, in the event of a successful exit, the investor can use the warrants to receive a share of the company's profits. The specific conditions for exercising the warrants, such as the type of exit event, are usually outlined in the warrant agreement.

A £2 million loan with a standard 12% coverage equates to £240.000 of the loan being in the form of a warrant, which will usually have a pre-determined strike price.

In most cases, that will mean £240.000 worth of shares at your current evaluation will be converted into equity at strike price, or at exit.

Though it sounds like a lot, it represents in the vast majority of cases in only 1-2% of equity dilution at exit. As you know, a funding round with a VC usually ranges anywhere between 15-30% of equity dilution. This really adds up at exit, 5 years down the line.

Capital Raising: Equity vs. Venture Debt Options...

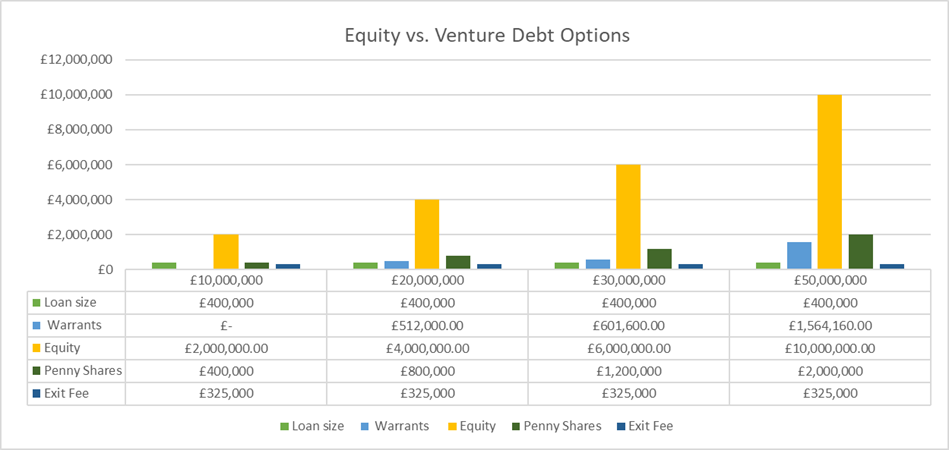

Let’s look at the figures for how we can determine this differential by taking an imaginary, yet realistic example.

The first row indicates the company’s valuation. We imagine a company that took a warrant with a strike price that hits anywhere after £10,000,000 valuation and see how the cost of capital acquisition varies, depending on which option you chose.

At a £50,000,000m valuation, we see that 20% equity dilution will represent £10,000,000mil at exit.

A Warrant, however, will only represent roughly 2-3% of equity dilution, at any given the 10 million valuation threshold.

3 "Types" of Warrants

The most common type of warrant consists of the coverage, then, and an exit fee that includes a fixed percentage of any proceeds past a certain point. The amount you will give in equity dilution will only strike at a certain increment of valuation, and thus, many warrants will never be exercised.

There is also what is called a fixed exit fee: at the end of the loan repayment, you pay a fixed exit fee. It’s similar to balloon payments when you take a loan to finance your car.

A third kind of “warrant” is called Penny Share: There’s no strike price, per se.

If you have planned your exit ahead, and have an idea about what you want them to look like, there’s an incumbent duty for you to know about these different setups.

Hiring an advisor throughout the venture debt deal negotiation process will always be a helpful way to start calculating the best scenarios for your preferred exit.

Are Warrants Changing?

In 2022, debt funds have claimed a rather unprecedented amount of success and a steady increase in debt flows, while VC performances steeply shrank. Debt funds realise that there is more demand for their products and see themselves to be in a stronger position, hence, they want more competitive warrants.

Now pretty much every company looks at venture debt as an option, understandably. After having been in the shadows of VCs, they want a larger piece of the cake. They do that by capturing some of the upside, using higher coverages, for example.

While warrants do kick in in case of an exit, the liquidation preference remains at 1x, unlike some VC deals which have liquidation preferences at 2,3 sometimes even higher liquidation preferences.

So while warrants are getting competitive, they do not exceed a certain threshold of cost for the founders.

This might in fact be due to the very reason that they want to stay competitive with other Venture Debt funds, to remain attractive in a booming market.

Does it Affect the Fundraising Process as a Founder?

This rather slight increase in warrant coverage does not really affect the cost of acquiring capital.

It has not reached a point whereby taking a Venture Debt offer is bad for your exit, and they will likely never get there.

If anything, warrants are rather beneficial to the fundraising process:

- On the one hand, they incentivise debt funds to make more offers, which is great for you as a founder, as you will get more opportunities.

- And on the other hand, even if they do hit (which, as we’ve seen, only happens with significant incremental growth), they do not dilute your equity by more than 2-3%.

They allow for more flexibility in your debt deal pricing and repayment window, and

If you’re interested and want to know more about how to negotiate the best term sheets for your company, fill out the form below (?)

.png)